california sales tax payment plan

Pay a 34 setup fee that will be added to my balance due. California requires businesses to file sales tax returns and submit sales tax payments online.

Depending on the volume of sales taxes you collect and the status of your sales tax account with California you may be required to file sales tax returns on a monthly semi-monthly quarterly.

. District Taxes Sales and Use Taxes PDF Drug Stores PDF Grocery Stores PDF Jewelry Stores PDF Interior Designers and Decorators PDF Liquor Stores. Most states charge a sales tax on select goods and services but California is in a league of its own. Pay a 34 set-up fee that the FTB adds to the balance due Make.

There is a state sales tax as well as local district taxes counties and cities. California has a statewide sales tax rate of 6 which has been in place since 1933. The tax rate for California is 725.

A commission agreement might provide for a. California sales tax varies by location. Municipal governments in California are also allowed to collect a local-option sales tax that ranges from.

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax. Groceries and prescription drugs are exempt from the California sales tax Counties. Individual taxpayers who owe up to 25000 to the California FTBFranchise Tax Board can pay in.

The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement. The California state sales tax rate is 75 and the average CA sales tax after local surtaxes is 844. Agreement to Prepare and Maintain Records in Accordance with International Registration Plan and California Apportionment Requirements.

Keep enough money in. A commission agreement might provide for a flat rate payment based on the number of products sold 33 Fixed-Floor. 7250 Note that the true California state sales tax rate is 6.

There is a statewide county tax of 125 and therefore the lowest rate anywhere in California is 725. For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12-month. Multiple district taxes can apply.

The payment plans are in addition to the previous assistance CDTFA has rolled out to small businesses for any taxes and fees administered by CDTFA. You can find the. How to Sign-in to Californias Website to File a Return.

The State of California has provided access to payment plans. Irvine CA Sales Tax Rate. Hollywood CA Sales Tax Rate.

Sales Use Tax in California. This includes the 600 state sales tax rate and an extra 125 local rate. Simplified income payroll sales and use tax information for you and your business.

LOS ANGELES AP Californias governor on Thursday said small businesses can keep up to 50000 in sales tax receipts for the next year as the COVID-19 outbreak has forced. There are also various district sales tax rates in California. California driver license number for individuals.

The California sales tax is a minimum of 725. First we will begin with simple step-by-step instructions for logging on to the website in order to file your sales tax. California has a statewide.

Pay by automatic withdrawal from my bank account. File the California Sales Tax Return You will do this with the California Board. Huntington Beach CA Sales Tax Rate.

Not only is this the highest. Glendale CA Sales Tax Rate. Make monthly payments until my tax bill is paid in full.

W2 Tax Document Business Template Tax Bill Template

Ca Ipcc Gst Question Bank Online Lectures Online Classes Constitution

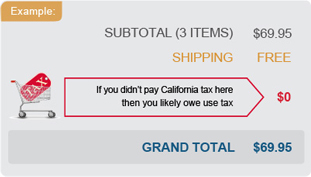

California Use Tax Information

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax

Free Purchase Agreement Template Pdf Legal Templates Purchase Agreement Resignation Letters Reference Letter

Sample Home Buyout Agreement Awesome California Lease Agreement Purchase Agreement Agreement Real Estate Contract

Download Best Of Sample Format Of Cover Letter For Job Application At Https Gprime Us Sample Fo Marketing Plan Template Event Planning Quotes Resume Examples

2020 1099 Misc Irs Copy A Form Print Template Pdf Fillable Etsy Print Buttons Templates Print Templates

All You Need To Begin Your Business In Tupperware Is A 30 Investment And You Get Everything You Need And Me Go Tupperware Consultant Good Meaning Tupperware

Browse Our Printable Eviction Notice California Template Eviction Notice Being A Landlord 3 Day Notice

Do You Have To Pay Separately For Your Trailers In Irp Registration Registration How To Plan Renew

New Homes For Sale In Porter Ranch California New Luxury Home Community Coming Soon To La Beacon At Hillcrest Luxury Homes Porter Ranch Home Design Plan

Pin On Drivers License California

New Payment Plan For Tax Lien Investing Home Study Course Investing Study Course Online Promotion

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Installment Payment Agreement Contract Template How To Plan Payment Agreement

Pin By Equilla Moore On Quick Saves California State Messages Unemployment